Content

Your accounting software should notify you of discrepancies automatically. There are a number of ways a business can make a cash disbursement, including the use of cash to make payments. Checks are often used to allow such disbursements to be more easily tracked and recorded by a business. The use of credit cards and similar methods has become increasingly popular, as credit cards have become more commonly accepted and allow a business to track disbursements and expenses more easily. A company can also use direct money transfers for cash disbursement purposes, usually through the transfer of funds directly from the account of the business into the account of a person or organization.

Upon verification, two authorized signors shall sign the checks or other documents and prepare them for distribution. In addition, the Treasurer shall prepare or cause to be prepared a check register. The check shall be presented to the City Treasurer along with the approved payroll statement or register.

A summary of total cash outflows and inflows may also be prepared to check the net cash flow of a certain period. Small and some medium businesses only use cash books to record their cash transactions. Examples include repayments to creditors, payments of rents and salaries, cash refunds for the return of goods, and so on. A disbursement is the paying out of funds, whether to make a purchase or other transaction. A disbursement can be made using cash or other methods of payment.

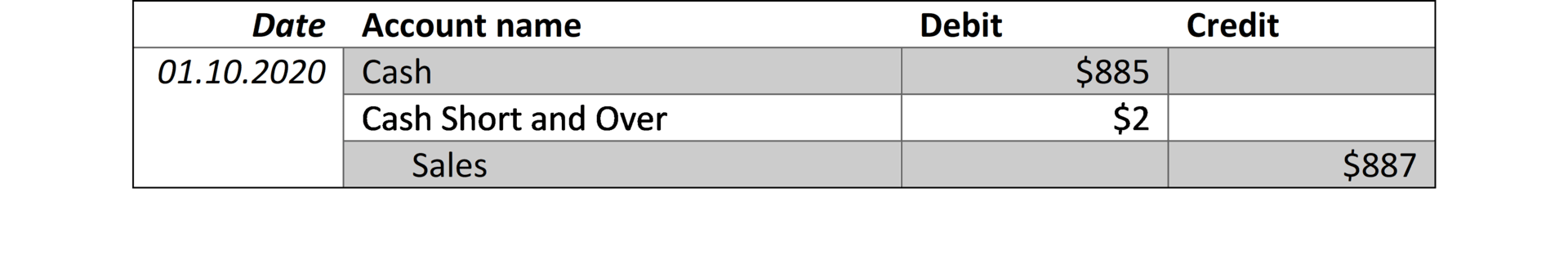

All entries in the cash disbursement journal have a credit to cash, as all the cash receipt journal entries have a debit to cash. A cash disbursement can be made with bills or coins, a check, or an electronic funds transfer. If a payment is made with a check, there is typically a delay of a few days before the funds are withdrawn from the company’s checking account, due to the impact of mail float and processing float. Are employees promptly terminated in your system or can they continue to receive checks or have checks written against their record?

What are the internal controls over cash disbursement? Who reviews and approves the disbursements? What support are required to have the disbursements done? At what threshold is the chairman required to sign of approve disbursement?

I think that's a good place to start. https://t.co/yrotf3mbQ3

— Kevon McIntosh, CA, CPA (@GirlDad876) November 22, 2021

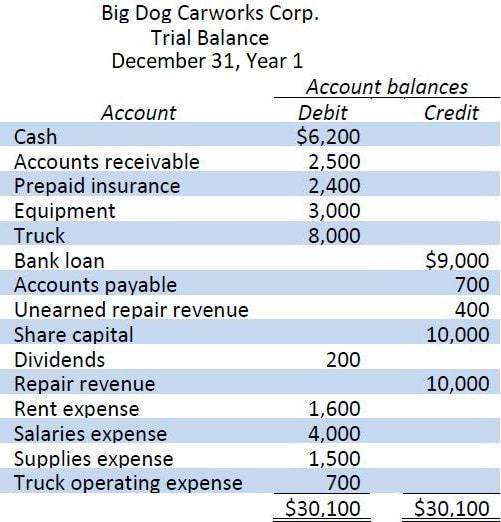

Speaking of cash books, the cash disbursements journal is actually derived from one. After looking at the flow of responsibilities at the pet store, can you see how internal controls have separated the jobs so that there is always more than one person who views the cash information? This helps keep theft and fraud at bay and protects the cash asset. Companies what are cash disbursements and individuals work hard to maintain control over the cash that they acquire. This lesson explores how this is done, looking specifically at the use of cash receipts and cash disbursements, and provides an example of these concepts in action. If the total cash inflows are greater than the total disbursements, a company’s net cash flow is positive.

Example Of A Cash Disbursement Journal

Since all cash outflow transactions are recorded in one place, it makes them easier to manage. It’s similar to a triple column cash book in that it has money columns for cash and bank transactions, as well as discounts. T’s called the Cash Disbursements Journal – an accounting record that is dedicated to recording all cash outflows of a business. That doesn’t mean that you can go ham with your cash disbursements though.

Expenditures should be well-documented with the original receipts from the individuals requiring reimbursement. Someone independent of the custodian should be replenishing this fund, reviewing supporting documentation and conducting surprise audits of petty cash.

Payments Or Reimbursement Example

This course qualifies as an elective in the completion of and the maintenance of the Local Finance Officer Certification Program for local government personnel in the State of Georgia. This course could also qualify for continuing professional education requirements for CPAs. Stamp the supporting documents as paid when liabilities are paid and indicate the date and number of the check issued.

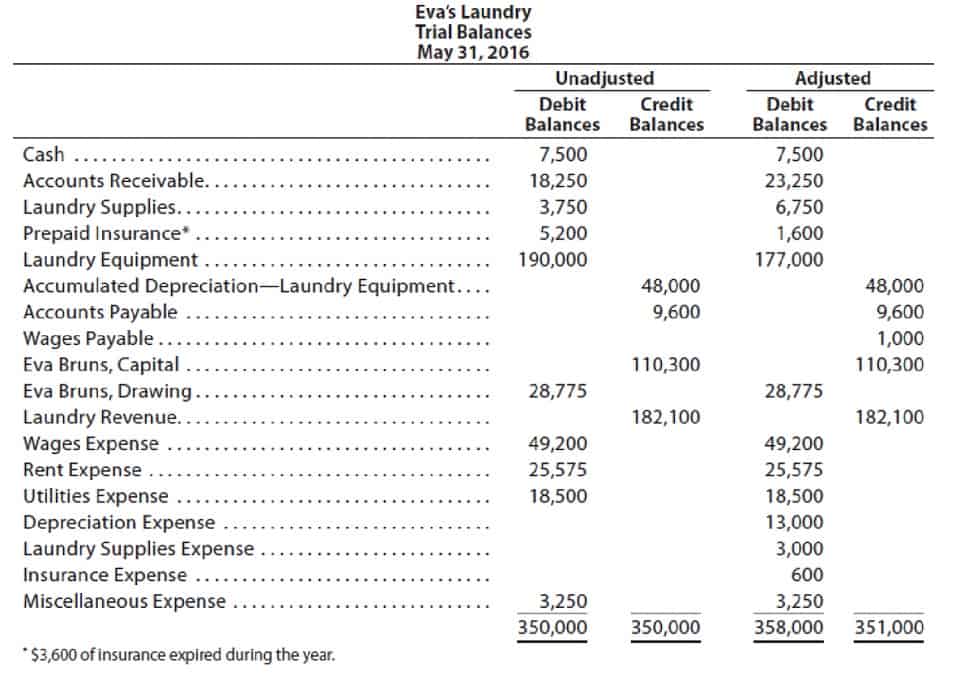

You must maintain an accounts receivable ledger account for each customer you extend credit to. Post your sales invoice charges from the sales and cash receipts journal to the customer ledgers at the end of each day. Also, whether you use a cash register or a separate cash receipts book, be sure to post cash receipts on account to the appropriate ledgers at the end of the day. Of course, your software should be able to take care of this automatically. Entries made in the sales and cash receipts journal are also totaled at the end of the month, and the results are posted to the accounts receivable account in your general ledger.

Accounting Information Systems: The Processes And Controls, 2nd Edition By

Both cash disbursements journal and cash receipts journal are derived from the cash book. With a cash disbursements journal, you can segregate all of a business’s cash outflow transactions. Though, a cash disbursements journal only records cash outflows whereas a cash book records both inflows and outflows.

The electronic check register shall be posted to the general ledger at least monthly. The general ledger shall be reconciled monthly to total bank disbursements as indicated on the monthly bank statements.

In general, it is more cost effective to use the Lehigh University OneCard, accounts payable check, or bank draft for smaller dollar payments. Wire transfers are processed by the Treasurer’s Office and should only be used when payments via one of these other methods are not accepted or are not feasible. Your accounting software should automatically keep an accounts receivable ledger account for each customer. The accounts receivable ledger, which can also double as a customer statement, serves as a record of each customer’s charges and payments. Nearly all businesses need some cash on hand to pay small, miscellaneous expenses.

What are the internal controls over cash disbursement? Who reviews and approves the disbursements? What support are required to have the disbursements done? At what threshold is the chairman required to sign of approve disbursement?

I think that's a good place to start. https://t.co/yrotf3mbQ3

— Kevon McIntosh, CA, CPA (@GirlDad876) November 22, 2021

The purchase of new equipment and upkeep can be an important expense handled through cash disbursement. Many companies also have a number of other operating expenses, such as website hosting and marketing or advertising campaigns and materials. This is because the volume of cash outflow transactions may not be enough to warrant maintaining a cash disbursements journal. It is a hybrid of a journal and a ledger that chronicles all the cash transactions of a business. In contrast, all the receipts of cash are recorded in the cash receipt journal.

Internal Controls Checklist For Cash Payments

The Treasurer shall compare the checks to the payroll statement or register and verify their accuracy. Upon verification, two authorized signors shall sign the checks and prepare them for distribution.

Also on February 2, you bought merchandise inventory on account from Ash Wholesale at a cost of $9,500. Stay updated on the latest products and services anytime, anywhere. FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work.

Services

Add up the deposits in transit, and enter the total on the reconciliation. Add the total deposits in transit to the bank balance to arrive at a subtotal. Keeping track of your cash, payables, and records can be challenging. Find out the most efficient ways to keep your money and your records in line and updated appropriately. Our solutions for regulated financial departments and institutions help customers meet their obligations to external regulators. We specialize in unifying and optimizing processes to deliver a real-time and accurate view of your financial position. Enabling tax and accounting professionals and businesses of all sizes drive productivity, navigate change, and deliver better outcomes.

- Stamp the supporting documents as paid when liabilities are paid and indicate the date and number of the check issued.

- Therefore, in cases where borrowing against restricted funds is permitted, the board should establish policies which describe the circumstances under which such borrowing is allowed.

- Each day, the credit sales recorded in the sales and cash receipts journal are posted to the appropriate customer’s accounts in the accounts receivable ledger.

- The sum of all your customer accounts receivable is listed as a current asset on your balance sheet.

- All entries in the cash disbursement journal have a credit to cash, as all the cash receipt journal entries have a debit to cash.

The University is committed to obtaining the best value relating to foreign currency transactions. A department requesting payment by bank draft in a foreign currency must forward a completed Accounts Payable Payment Approval Form along with the appropriate supporting documentation to Accounts Payable. The payment request form must include the full name and address of the vendor to be paid, currency to be used for disbursement, the EXACT amount in the foreign currency, and Banner account information. No payroll related encumbrances are required to be recorded in the budgetary accounting records as long as the payroll costs are recorded as expenditures at the time they become due and payable. However, no payroll costs may be incurred or paid if they exceed the available appropriation for the accounts to be charged at the legal level of control.

All disbursements should be accompanied by adequate documentation, in the form of receipts or an invoice. Cash withdrawals should never be made via automatic teller machine cards. Get up and running with free payroll setup, and enjoy free expert support. After posting the information to your ledger, calculate new balances for each account. In general, the difference between reimbursement and disbursement is that one is the instance or process of disbursing while the other is the act of paying.

As previously mentioned the accounts have been maintained substantially on a cash basis. Accordingly, the attached statements do not reflect the liabilities and commitments of the Organization as at 31 December 1946. During the three-month period ended 31 March 1947 approximately $141,000.00 was disbursed for 1946 expenses. This reconciliation is necessary because the cash balance in your books will never agree with the balance shown on the bank statement. The delay in checks and deposits clearing the bank, automatic bank charges and credits you haven’t recorded—and errors you may have made in your books—render the ideal impossible. Management can use the cash disbursements journal to assess the business’s cash outflow. A cash disbursements journal is summarized at the end of the period, usually a month.

The sum of the amounts you owe to your suppliers is listed as a current liability on your balance sheet. Write another check to “Petty Cash” for the total of the expenses.

In general, disbursement is a term that describes the spending and distribution of money from a financial institution. Instead of merely recording income and expenses, it shows when the payment will be received and when cash must be dispersed. If you book a $1,000 sale and your cost to deliver your product is $600, you’ve made a $400 profit. While that looks good on paper, that doesn’t mean you have the $400 to pay your bills. Maybe you bought $300 worth of supplies and paid workers $200 to make the product. If you offer your customer 45-day terms, you won’t have the money to pay your supplier or employees unless you keep enough cash on hand or have enough credit available.

You can prevent your business from falling victim to these practices by screening those likely to commit frauds before they’re hired. It’s been said “cash is king.” This is especially true for perpetrators of fraud. For over 60 years, our knowledgeable and experienced team of CPAs and business consultants have been serving individuals and businesses in Western New York and around the nation. A charge (currently $22) is assessed to the requestor’s Banner account to partially offset the cost of the foreign wire transfer. All long-term indebtedness, in the form of bonds, notes or lease purchase obligations, shall only be incurred in the manner provided by law.

No irregularity in Ehsaas Cash disbursements: Dr Sania – The Nation

No irregularity in Ehsaas Cash disbursements: Dr Sania.View Full Coverage on Google News

Posted: Mon, 29 Nov 2021 21:44:00 GMT [source]

At that time, the treasurer or other board members may review the disbursements and make sure that they are within the guidelines established by the board. Once these disbursements have been reviewed and accepted, the authorized board representative then transfers enough money to bring the imprest account back to its $500 maximum balance. Here are some examples of disbursements and their entries for better understanding.

One of the first things a small business should educate themselves on is payment-related processes. Doing things wrong in the beginning means penalties, fees, and failed audits. That’s why, when making payments out of a business, it’s important to understand every which way the cash flows. Disbursement is the act of paying out or disbursing money, which can include money paid out for a loan, to run a business, or as dividend payments. The University does not normally hedge against foreign currency transactions as a matter of general practice. A charge (currently $3.50) is assessed by the bank and charged to the department for this service. After being processed, the bank will send the Bank Draft to Accounts Payable who will notify the individual who prepared the request that the payment is ready for pickup .

Author: Stephen L Nelson

Gà chọi c1… yeah, still cockfighting. Different search term, same place. Definitely a niche thing. Dive in at your own risk. See for yourself: gà chọi c1